Diabetes Devices Market Reaches $33.4 Bn in 2024 | Strong Growth Ahead by 64.8 Bn 2033

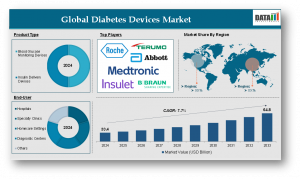

The Diabetes Devices Market was valued at US$ 33.4 Billion in 2024 and is projected to reach US$ 64.8 Billion by 2033, growing at a CAGR of 7.7%.

The U.S. diabetes devices market is witnessing strong growth, driven by rising diabetes cases and tech adoption, contributing significantly to the $33.4B global market in 2024.”

AUSTIN, TX, UNITED STATES, June 20, 2025 /EINPresswire.com/ -- The Diabetes Devices Market Size was estimated at US$ 33.4 Billion in 2024 and is anticipated to expand consistently, reaching around US$ 64.8 Billion by 2033. The market is forecasted to grow at a CAGR of 7.7% from 2025 to 2033, driven by rising demand for advanced monitoring and insulin delivery technologies.— DataM Intelligence

The Diabetes Devices Market was valued at USD 29.39 billion in 2022 and saw a notable increase, reaching USD 31.24 billion in 2023, reflecting strong market growth.

To Download Sample Report: https://datamintelligence.com/download-sample/diabetes-devices-market

Industry Development:

In September 2024, Senseonics Holdings, Inc. and Ascensia Diabetes Care received FDA approval for their next-generation Eversense 365 CGM system, designed for adults aged 18 and above with Type 1 or Type 2 diabetes. The Eversense 365 is the world’s first continuous glucose monitoring system with a full-year sensor lifespan, marking a major advancement in diabetes care and long-term glucose tracking.

Also in September 2024, Embecta Corp. secured 510(k) clearance from the FDA for its innovative disposable insulin delivery system, tailored for adults managing Type 1 and Type 2 diabetes. The system includes a tubeless patch pump with a 300-unit insulin reservoir, designed using feedback from individuals with Type 2 diabetes and healthcare providers, delivering a more personalized and convenient insulin management solution more user-centric approach to insulin therapy.

Regional Outlook

North America

North America led the Diabetes Devices Market in 2022 with a market size of US$ 11.10 billion and expanded further to US$ 11.80 billion in 2023.

North America dominates the diabetes devices market, particularly the United States. The region has a strong infrastructure, high awareness levels, and substantial government initiatives supporting diabetes care. Public and private insurers in the U.S. are increasingly covering advanced diabetes technologies, helping to fuel demand.

Europe

Europe follows closely, with countries like Germany, France, and the UK leading the way in device adoption. Supportive reimbursement frameworks and regulatory approvals for new technologies are contributing to the market’s expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, Japan, and India. The growth here is primarily due to urbanization, lifestyle changes, and increasing obesity levels. Awareness campaigns and improvements in healthcare access are helping to drive up adoption rates.

Latin America & Middle East

While still emerging, Latin America and the Middle East & Africa regions are expected to see consistent growth. Increasing investments in healthcare infrastructure and partnerships with international device manufacturers are accelerating progress.

Recent FDA Approvals and Breakthroughs in Diabetes Technology

With the rising demand for advanced diabetes care solutions, leading healthcare companies are introducing groundbreaking innovations to improve disease management and accessibility:

Abbott’s OTC CGM Systems Cleared by FDA (June 2024): Abbott received FDA clearance for two over-the-counter continuous glucose monitoring (CGM) systems, marking a major advancement in making glucose tracking more accessible to consumers without prescriptions.

Tandem Mobi & Dexcom G7 Integration (May 2024): Tandem Diabetes Care announced that its Tandem Mobi Insulin Pump is now compatible with the Dexcom G7 CGM, enabling seamless, real-time monitoring and optimized insulin delivery for better glycemic control.

FDA Approval for CamDiab’s Closed-Loop Insulin App (May 2024): CamDiab’s hybrid closed-loop insulin delivery app earned FDA approval, offering users automated insulin adjustments based on live glucose readings—redefining convenience and precision in diabetes care.

Sequel’s twiist Insulin Delivery System Approved (March 2024): Sequel secured FDA 510(k) clearance for its twiist automated insulin delivery system, designed to enhance efficiency and ease of use for insulin-dependent individuals.

First OTC CGM Device Cleared by FDA (March 2024): A milestone in diabetes technology, the FDA approved the first-ever over-the-counter CGM device, empowering users to manage their glucose levels independently and more proactively.

Launch of Tandem Mobi Insulin Pump (February 2024): Tandem Diabetes Care introduced Tandem Mobi, the smallest and most robust automated insulin delivery device to date, setting new benchmarks in wearable insulin technology focused on comfort and user-friendliness.

Key Companies Driving the Market

Several players are shaping the global diabetes devices market with continuous innovation and strategic partnerships:

F. Hoffmann-La Roche Ltd

Abbott Laboratories

Medtronic plc

Terumo Corporation

B. Braun SE

Insulet Corporation

Nipro Corporation

Johnson & Johnson Services, Inc.

Senseonics, Inc.

Tandem Diabetes Care, Inc

Market Segmentation:

By Product Type: Blood Glucose Monitoring Devices, Continuous Glucose Monitoring Devices, Sensors, Transmitters, Receivers, Self-Monitoring Devices, Blood Glucose Meters, Testing Strips, Lancets, Insulin Delivery Devices, Insulin Pumps, Insulin Pens, Insulin Syringes, Others

By End-User: Hospitals, Specialty Clinics, Homecare Settings, Diagnostic Centers, Others

Regional Analysis: North America, U.S., Canada, Mexico, Europe, Germany, U.K., France, Spain, Italy, Rest of Europe, South America, Brazil, Argentina, Rest of South America, Asia-Pacific, China, India, Japan, South Korea, Rest of Asia-Pacific, Middle East and Africa

Buy Now & Unlock 360° Market Intelligence:: https://datamintelligence.com/buy-now-page?report=diabetes-devices-market

Latest News in the USA

In 2025, the U.S. diabetes device landscape is experiencing a notable push towards Medicare expansion for CGM systems. Earlier this year, federal approval was granted to expand CGM coverage to more Type 2 diabetes patients, particularly those not using insulin. This marks a pivotal moment for broader access and affordability, especially for seniors.

Additionally, Dexcom launched its G8 model in early 2025, featuring an ultra-thin sensor with improved calibration-free technology and a 15-day wear period. The company also announced partnerships with major pharmacy chains to enable direct retail access, simplifying the buying process for users.

The FDA has also cleared a new AI-based insulin delivery algorithm, developed in collaboration with Medtronic, which adapts to individual patterns in real-time. This innovation supports safer insulin titration and is expected to reduce hypoglycemia episodes significantly.

Latest News in Japan

Japan, traditionally cautious in embracing new medical technologies, has shown rapid advancement in 2025. This year, the Ministry of Health, Labour and Welfare (MHLW) approved Dexcom G7 and Medtronic’s Smart MDI platform, marking a big leap in the Japanese diabetes tech market.

Meanwhile, Omron Healthcare, a homegrown brand, announced the release of a wearable non-invasive glucose monitoring patch that uses microneedle and infrared technologies. Currently undergoing pilot trials in Tokyo hospitals, the device is gaining attention for its potential to eliminate finger-prick tests entirely.

In another significant development, Japan’s national insurance program has started partial reimbursement for smart insulin pens, making it easier for patients to afford tech-enabled solutions. The government is also running awareness campaigns targeting youth diabetes, signaling a stronger preventive approach to disease management.

Conclusion

The diabetes devices market is entering a dynamic phase of transformation, fueled by innovation, accessibility, and rising global demand. With increased focus on preventive care, smart technology, and patient-centered design, the market is poised for sustainable and inclusive growth. As new regions adopt these technologies and existing ones evolve further, 2025 and beyond hold strong promise for improved diabetes management worldwide.

Purchase Your Subscription to Power Your Strategy with Precision: https://www.datamintelligence.com/reports-subscription

Here are the Experts Researched Related Reports By DataM intelligence

Glucose Monitoring Devices Market Size 2025-2033

Insulin Pen Market Size By 2031

Sai Kiran

DataM Intelligence 4Market Research

+1 877-441-4866

Sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.